In the emerging Asia-Pacific market, as the digitalization process accelerates, the application of big data technology is becoming more widespread, and its development trends and vendors' comprehensive competitiveness are becoming increasingly important. First of all, the accelerated urbanization process and the rapid development of e-commerce have brought about a massive demand for big data processing capabilities. The widespread application of technologies such as cold and hot data storage, edge computing, and intelligent data lakes not only helps companies optimize storage and computing resources, but also improves their business responsiveness through real-time data processing, especially in high-traffic industries such as e-commerce and finance. In addition, AI for Data and automated data processing technologies further enhance the efficiency of data analysis, enabling businesses to make more accurate decisions in complex market environments. As data privacy protection regulations become increasingly stringent in the Asia-Pacific region, vendors must provide security and compliance solutions that meet local regulations, ensuring data privacy while also meeting customers' needs for localized storage. The competitiveness of big data vendors lies in their ability to innovate, the stability of their platforms, and their precise understanding of industry customers' needs. Vendors with strong technical R&D capabilities can quickly provide innovative solutions to help companies respond flexibly to market changes and improve operational efficiency. Overall, the development of big data technology in the emerging Asia-Pacific market is showing trends towards intelligence, real-time processing, and enhanced security

The accelerated urbanization and rapid development of the digital economy in the Emerging Asia-Pacific region have led to diversified demands for big data services. Countries like Indonesia, Thailand, and the Philippines are experiencing rapid urban population growth, resulting in a significant increase in data generation in areas such as traffic management, energy usage, and public services. Although the e-commerce market in the region is relatively small, it is on an upward trend overall, with large platforms continuously increasing their demand for data storage and analysis. In this context, companies are increasingly relying on flexible cold and hot data storage solutions, optimizing resource allocation to balance cost and performance. The growing demand for personalized services in sectors such as fintech and healthcare is also driving the development of big data platforms. Real-time data analysis and intelligent data platforms are becoming key technologies to help businesses deliver more precise services. Telecom operators are leveraging big data technology to improve user experience and enhance decision-making through real-time data insights. E-commerce platforms such as Shopee and Lazada rely on real-time data processing technologies to track customer behavior and respond swiftly to market changes. With stricter data privacy regulations being implemented, businesses are increasingly seeking compliance and localized data storage solutions, driving the rapid expansion of local data centers and cloud service markets to ensure data security and privacy in accordance with local regulatory requirements.

The integration of AI for Data, edge computing, intelligent data lakes, and hybrid cloud technologies is expected to enhance the data processing capabilities of enterprises in the emerging Asia-Pacific region, helping them address the challenges of large-scale, real-time data. AI for Data replaces traditional data governance with automated data processing tools, significantly improving the efficiency of enterprise data management. Leveraging AI-driven automated data cleaning and parameter tuning technologies, enterprises can dynamically adjust platform parameters based on real-time business needs, optimizing data processing speed and accuracy. Fintech and healthcare are key sectors for the application of this technology, where financial institutions use AI for Data to accelerate the development of personalized services, and healthcare organizations optimize patient management processes by efficiently processing unstructured data such as electronic medical records. Meanwhile, the widespread adoption of hybrid and multi-cloud technologies enables enterprises to flexibly allocate resources between private and public clouds, improving data processing efficiency while reducing costs. In sectors such as retail and manufacturing, the combination of edge computing and intelligent data lakes helps enterprises collect and analyze IoT data in real-time, further enhancing the intelligence of supply chain management and production scheduling. As IoT devices become more prevalent, edge computing is expected to play a key role in smart city projects, enhancing urban functionalities such as traffic management and energy efficiency through real-time data processing.

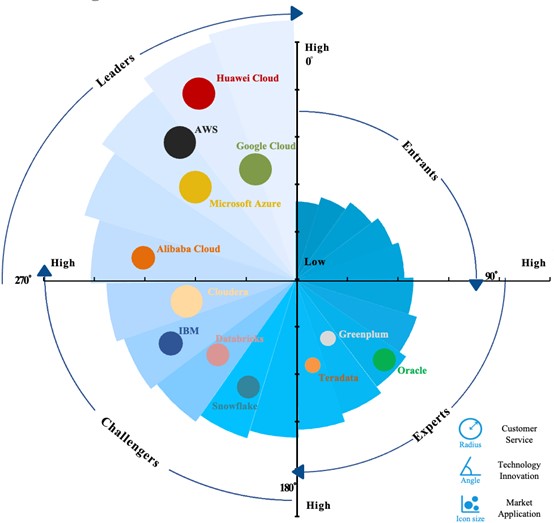

Despite the increasingly competitive landscape in the emerging Asia-Pacific big data market, Huawei Cloud has secured a leading position through its comprehensive competitiveness. Compared to other competitors such as AWS, Microsoft Azure, Google Cloud, and Alibaba Cloud, Huawei Cloud excels across multiple dimensions. First, in terms of market performance, Huawei Cloud’s expansion in emerging markets like Indonesia, Thailand, and the Philippines is remarkable, demonstrating strong adaptability and industry penetration, particularly in sectors such as finance, government, and telecom operators. Especially in the telecom industry, Huawei Cloud leads in revenue among major providers due to its powerful technical capabilities, deep understanding of telecom operations, and localized services. Its big data solutions meet the diverse needs of various industries, providing efficient and reliable services that support digital transformation. Second, technological innovation is another major competitive advantage for Huawei Cloud. With technological breakthroughs in intelligent data lakes, lakehouse integration, elastic scaling, and AI integration, Huawei Cloud not only excels in real-time data processing but also offers smarter decision support through AI-driven automated optimization algorithms. Its innovations in data storage, fault tolerance, and high availability further enhance its ability to handle complex data scenarios. Additionally, Huawei Cloud stands out in customer service, offering localized support and data security and compliance solutions. Its strong customer service and after-sales support enable enterprises to confidently utilize its services, especially under strict data privacy regulations in the Asia-Pacific market. Besides Huawei Cloud, AWS, Microsoft Azure, Google Cloud, and Alibaba Cloud have also established themselves as leaders in this market with their accumulated technology and market performance, particularly excelling in data security, compatibility, and cloud-native technologies. Cloudera and Databricks, categorized as "challengers," rapidly expand their market share with cost-effective products and more open ecosystems. Meanwhile, Teradata and Greenplum, regarded as "specialists," focus on specific domains, providing high-quality, customized solutions with notable advantages in enterprise-grade big data platforms and data warehouses.

In 2023, Huawei Cloud and Azure remained dominant in the revenue performance of big data service providers in the telecom and government sectors across the emerging Asia-Pacific region. The chart shows that in the telecom sector, Huawei Cloud, with its strong technical capabilities and localized services, outperformed other major service providers such as Cloudera, AWS, and Google in terms of revenue. Huawei Cloud's extensive application in the telecom industry, particularly in data storage, real-time data processing, and intelligent network optimization, has led to a continuous increase in its market share in this field. At the same time, Azure has demonstrated outstanding performance in the government sector, surpassing competitors such as Huawei Cloud, AWS, and Google to become the top player in government services. Azure's excellent capabilities in data security, cloud computing compliance, and localized support have earned it the trust of government customers. These two service providers have further strengthened their market leadership by continuously optimizing technical solutions and providing high-quality services in various industries, contributing significantly to the development of big data in the emerging Asia-Pacific region.

In 2023, Azure, AWS, and Huawei Cloud led the revenue performance of big data service providers in the financial and internet sectors across the emerging Asia-Pacific region. According to the chart, Huawei Cloud, Azure, and Google showed strong revenue performance in the financial sector, thanks to their technological advantages and broad market coverage. Particularly in areas such as data security, real-time data analysis, and personalized services, these three providers' solutions have helped financial enterprises address data processing challenges effectively and accelerated the pace of digital transformation. On the other hand, the internet sector was dominated by AWS, Azure, and Huawei Cloud in terms of revenue performance. AWS, with its powerful elastic computing capabilities and global infrastructure network, has become the preferred big data service provider for internet companies. Azure and Huawei Cloud followed closely behind, demonstrating strong competitiveness in real-time data processing, user behavior analysis, and intelligent decision support on internet platforms. Google, leveraging its expertise in AI and data processing technologies, closely trailed the top three providers and expanded its market share through continuous innovation.

In 2023, the big data service market in Singapore and Indonesia presented a highly competitive landscape, with AWS and GCP leading the market. According to the chart, AWS, with its globally leading cloud infrastructure and wide range of services, holds a dominant market share in both Singapore and Indonesia. GCP (Google Cloud) closely follows, excelling in data processing, AI integration, and data analysis, positioning itself as a key player in these markets. After these two giants, Huawei Cloud, Azure, and Cloudera also showed strong market performance. Huawei Cloud, with its localized services and robust technical capabilities, has steadily expanded its market share in Singapore and Indonesia. Azure, leveraging its strengths in data security and enterprise-level cloud services, continues to strengthen its market position. Cloudera, specializing in big data platforms and enterprise-level data management solutions, has shown steady growth in the emerging Asia-Pacific market. These five service providers, through technological innovation and localized services, are driving the continued growth of the big data market in Singapore and Indonesia.

In 2023, Huawei Cloud, Azure, and AWS maintained their leadership positions in the Hong Kong big data service market, while Azure and GCP dominated the Malaysian market, with Huawei Cloud closely following. In Hong Kong, Huawei Cloud has become the preferred service provider due to its strong localized support, robust technical capabilities, and deep application in the finance and government sectors. Azure, on the other hand, continues to solidify its influence in the region by offering excellent enterprise-level cloud services and multi-cloud management solutions, meeting the diverse needs of businesses. AWS, with its leading elastic computing capabilities and extensive infrastructure network, also holds a significant position in the Hong Kong big data service market. Additionally, Cloudera and GCP, leveraging their open data platforms and flexible solutions, are gradually expanding their market shares. In Malaysia, Azure and GCP lead the market. Azure, with its flexible multi-cloud and hybrid cloud services, meets the needs of various industries, while GCP, with its outstanding data processing capabilities and AI integration technology, holds a strong position in data-intensive industries. Huawei Cloud, with its localized services and continuous technological innovation, follows closely behind, further strengthening its market position. AWS and Databricks have also shown steady growth in this market, maintaining strong competitiveness.

In the big data service market in Thailand and the Philippines, Huawei Cloud and AWS lead the way, with other providers closely following. In Thailand, Huawei Cloud holds the top spot, thanks to its localized advantages, extensive industry applications, and strong technical support, particularly in the finance, government, and telecom sectors, where it demonstrates strong adaptability and coverage. AWS follows closely, becoming the top choice for multinational companies through its elastic computing capabilities and global infrastructure. Azure and GCP are also expanding their market shares, providing flexible solutions for local businesses with their multi-cloud management and data processing capabilities. Cloudera and other providers are steadily enhancing their competitiveness in big data platforms and data management, showing steady growth. In the Philippines, AWS leads the market with its robust cloud service ecosystem and data security solutions. Huawei Cloud, with its strong localized support and data compliance solutions, follows closely behind. Azure and Cloudera continue to strengthen their positions in the Philippines market through flexible cloud solutions and big data platforms, while IBM, with its extensive experience in enterprise-level services, holds a certain advantage in specific industries.

The big data service market in Bangladesh and Sri Lanka is led by Huawei Cloud and Cloudera. In the Bangladesh market, Huawei Cloud occupies a dominant position due to its strong localized support capabilities and extensive industry applications, especially in the telecommunications and finance sectors. Cloudera, through its advantages in big data management and analytical solutions, also plays a leading role alongside Huawei Cloud. AWS and Azure closely follow, with AWS continuously expanding its market share due to its global cloud infrastructure and powerful elastic computing capabilities, while Azure helps local enterprises achieve multi-cloud and hybrid cloud deployment needs with its enterprise-level solutions. In the Sri Lankan market, Cloudera similarly holds a leading position, meeting the diverse needs of local businesses through its open big data ecosystem and flexible integration capabilities. Huawei Cloud follows closely, providing robust technical support and data security compliance solutions. Azure and AWS also perform well in the Sri Lankan market, with Azure broadly serving multiple industries through its cloud computing solutions and AWS showcasing unique advantages in elastic computing and real-time data processing.

Overall, in 2023, the big data service market in the emerging Asia-Pacific region has exhibited a competitive landscape, with different service providers performing variably across countries and industries. Huawei Cloud, with its localized support and strong technical capabilities, has dominated several markets, especially in regions such as Hong Kong, Thailand, and Bangladesh. AWS has established a significant presence in the Philippines and Sri Lanka, particularly in the internet and finance sectors, showing robust growth. Azure continues to expand its share in markets like Malaysia and Sri Lanka through its enterprise-level cloud services and multi-cloud management solutions. GCP (Google Cloud) has attracted numerous customers in Malaysia and the Philippines due to its AI integration and data processing capabilities. Meanwhile, Cloudera has gradually emerged in markets like Bangladesh and Sri Lanka, leveraging its open big data ecosystem and flexible integration solutions. Other vendors such as IBM and Oracle have also achieved steady growth in specific markets due to their industry expertise. As big data technology continues to be widely adopted in the emerging Asia-Pacific market, service providers are continually innovating and upgrading their services to meet the increasing demands for data management, analysis, and security, driving rapid market expansion.